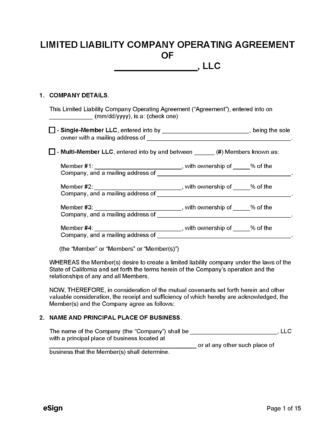

California LLC Operating Agreement Template

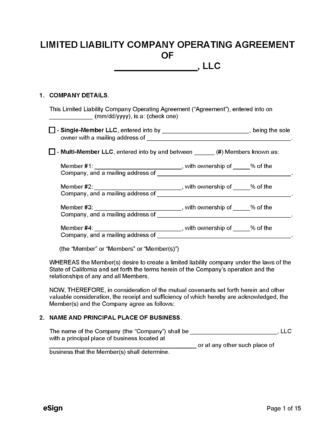

A California LLC operating agreement is a document that governs a limited liability company’s operations and details every aspect of its internal structure. The agreement identifies the company’s ownership along with their capital contributions and voting rights. It also details how the LLC intends to handle certain transactions, such as profit distribution, adding or removing members, annual meetings, and company dissolution.

While an operating agreement is not mandatory in most states, California LLCs are required to draft the contract during the initial registration process with the Secretary of State. The completed agreement must then be stored at the company’s designated office.

Contents

Types (2)

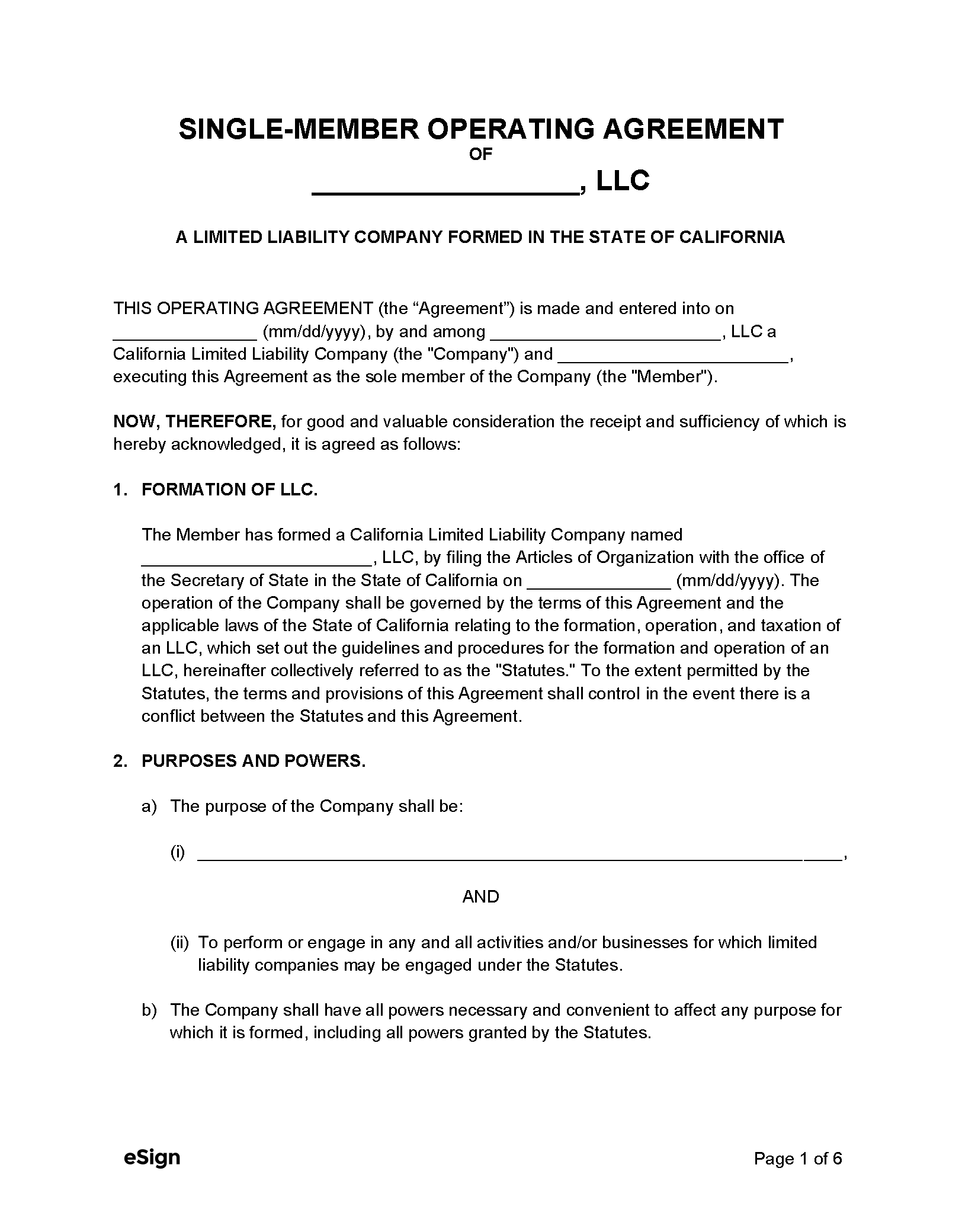

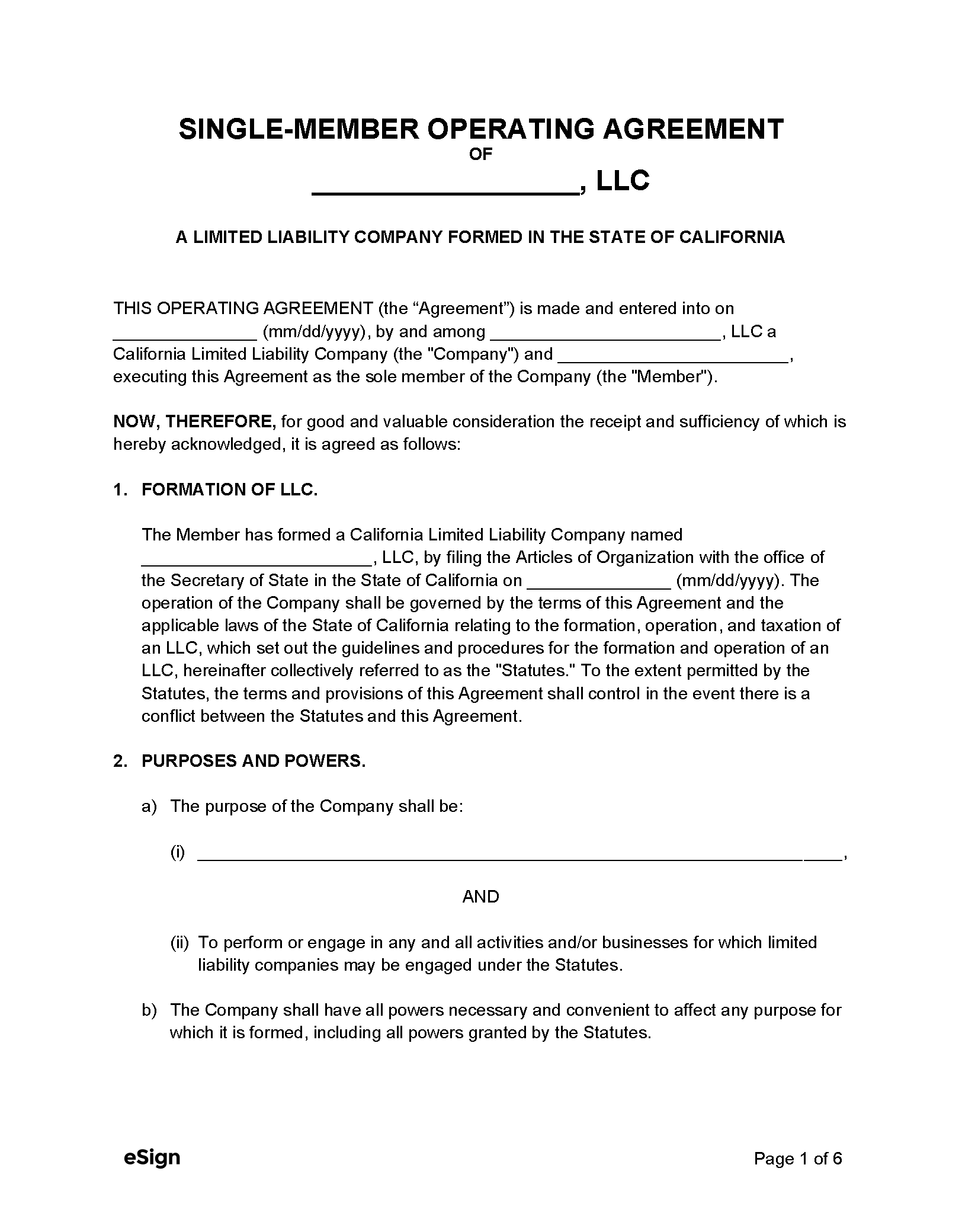

Single-Member LLC Operating Agreement – For establishing the operating procedures of an LLC that has one (1) owner only.

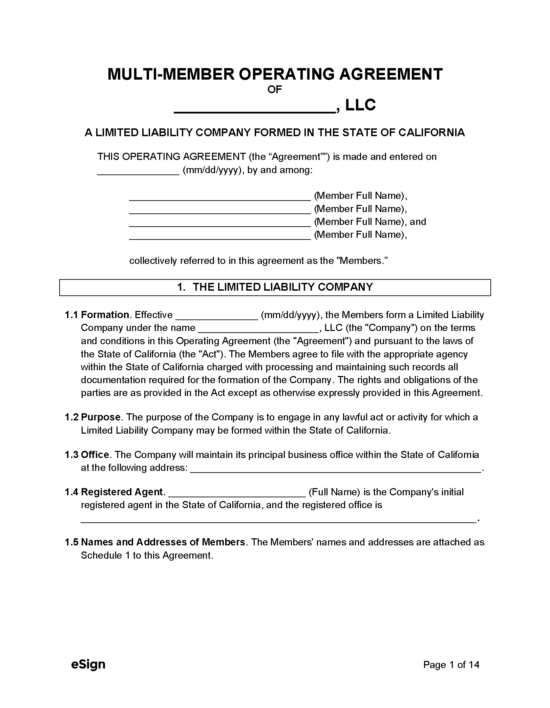

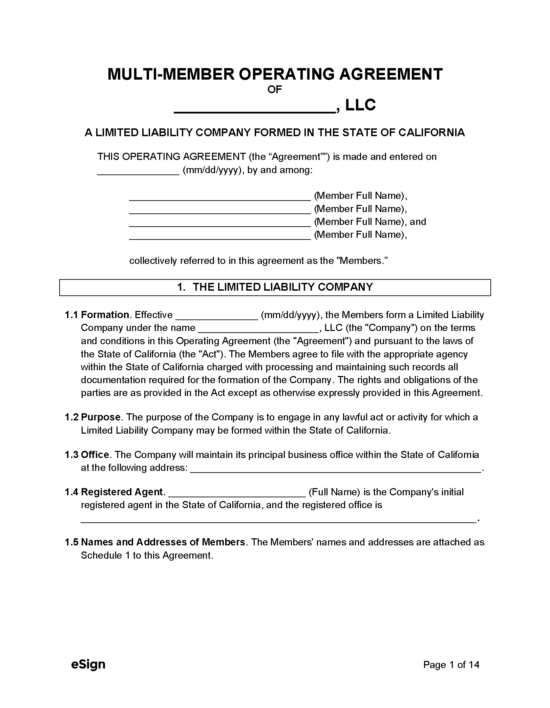

Multi-Member LLC Operating Agreement – An operating agreement for LLCs with more than one (1) owner.

Laws

How to File (5 Steps)

- Step 1 – Choose and Reserve an Entity Name

- Step 2 – File the Articles of Organization

- Step 3 – Draft an Operating Agreement

- Step 4 – Apply for an EIN

- Step 5 – File a Statement of Information

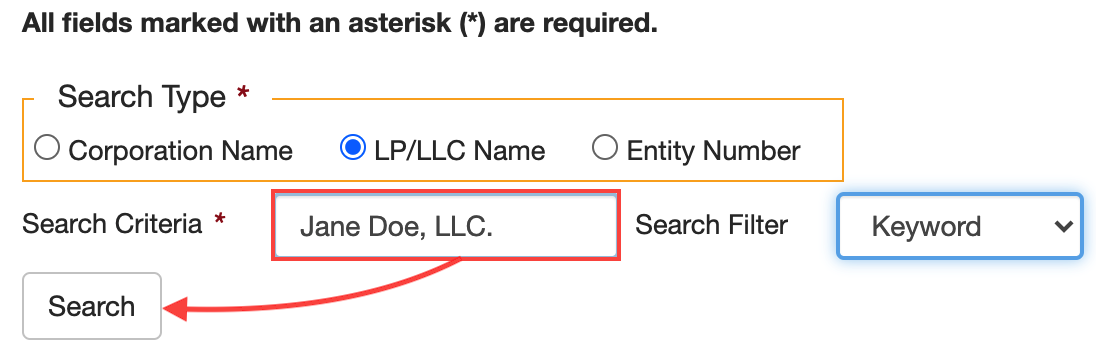

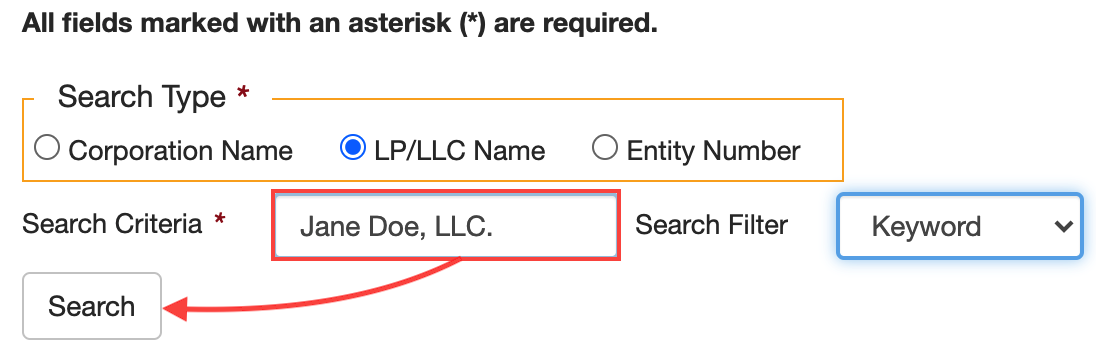

Limited liability companies must choose a business name that is distinguishable from those registered or reserved with the Secretary of State. A preliminary business search can be conducted to check the name’s availability.

After selecting a name, it can be reserved for sixty (60) days using a Name Reservation Request (filing instructions included in the document). Name Reservation Requests must be accompanied by a $10 check made out to the “Secretary of State.”

Note on Entity Names:

The name of an LLC must include the words “limited liability company” or the abbreviations “LLC” or “L.L.C.” It must also comply with naming regulations imposed by § 7701.08.

Step 2 – File the Articles of Organization

An LLC will need to file the Articles of Organization with the Secretary of State in order to register the business. If the company is a foreign entity (one previously created out-of-state or out-of-county), the LLC must instead file the Application to Register a Foreign Limited Liability Company.

Domestic LLCs

- Online Application:

- Fill out the electronic application.

- Pay the $70 filing fee using a credit card.

- Paper Application:

- Complete the Articles of Organization (Form LLC-1).

- Attach a $70 check made out to the “Secretary of State.” A separate payment of $15 is required if filing in person. Credit cards are also accepted when filing in person.

- Send the application and filing fee(s) to the Secretary of State’s Sacramento Office via mail or in-person delivery.

Foreign LLCs

- Online Application:

- Download and print the Application to Register a Foreign Limited Liability Company (Form LLC-5).

- Fill out and print the application, and then sign it using ink.

- Scan the completed application and save it as a PDF.

- Upload the PDF to the Business Entities eForms filing portal.

- Pay the $70 filing fee with a credit card.

- Paper Application:

- Complete the Submission Cover Sheet.

- Fill out the Application to Register a Foreign Limited Liability Company (Form LLC-5).

- Print the application and sign it using ink.

- Attach a check for $70 payable to the “Secretary of State.” If filing in person, an extra $15 is required. When filing in person, credit cards are also accepted.

- Obtain a Certificate of Good Standing (a.k.a. Certificate of Existence) from the agency in the state or country where the foreign LLC is registered.

- Submit all documents and the filing fee(s) to the Secretary of State’s Sacramento Office. Submission can be accomplished by mail or in person.

Step 3 – Draft an Operating Agreement

Each LLC will need to draft an operating agreement to define the company’s management structure and business procedures. The document needn’t be filed with the Secretary of State but instead kept at the LLC’s designated office.

- Single-Member Operating Agreement

- Multi-Member Operating Agreement

Step 4 – Apply for an EIN

An EIN, or “employer identification number,” is a code used by the IRS to identify LLCs and other business entities. Limited liability companies will need an EIN to conduct certain business transactions, such as hiring employees and opening company bank accounts.

- An EIN can be obtained online or through the mail with Form SS-4.

Step 5 – File a Statement of Information

Within ninety (90) days from the entity’s registration date, a Statement of Information must be filed with the Secretary of State to revise any outdated company information. It’s best to file the statement online, although the PDF version (Form LLC-12) can be submitted by mail or in person at the Sacramento Office.

Note on Statement Information:

- Payment of a $20 fee is required upon filing.

- If the company has more than one (1) manager, Form LLC-12A must also be filed.

- The LLC must file the Statement of Information every two (2) years (see filing schedule).

Resources

Costs:

- Domestic filing fee: $70

- Foreign filing fee: $70

- Name reservation: $10

- Statement of information fee: $20

Forms:

- Name Reservation Request (PDF)

- Articles of Organization (Online) (PDF)

- Application to Register a Foreign Limited Liability Company (Online) (PDF)

- Statement of Information (Online) (PDF)

- Attachment to Statement of Information (PDF)

- Submission Cover Sheet (PDF)

Links:

- Where to file: Secretary of State

- File online: Online Filing Service

- Entity search: Business Search

- Obtain business license: California Department of Tax and Fee Administration