Foreign collaboration is an alliance (union or an association) incorporated to carry on the agreed tasks collectively with the participation of the resident and non-resident entities. The central concept of foreign collaboration is joint participation between host and foreign countries for the establishment of an organic form of enterprise in the host country involving profit-seeking relationships. It is an inflow of foreign capital and technology for the host country which is backed by commercial considerations of profit and private expectations.

As no country is self-sufficient, all countries are reliant on one another to satisfy their needs. Interdependence between countries is a common phenomenon. A foreign partnership is extremely beneficial in addressing resource shortages and obtaining advanced technology at a low cost.

Due to the consequences of liberalization, privatization, and globalization, foreign participation in the Indian market is rapidly rising. Indian companies are interested in foreign counterparts since the foreign market may provide them with technical and market expertise.

In India, foreign collaboration agreements are being made between Indian and foreign companies through the sale of technology, spare parts, and the use of foreign brand names for its final products. Foreign capital in India is governed by the Foreign Exchange Management Act, 1999 and rules and regulations made by RBI.

The Government of India periodically publishes a list of industries in which foreign investment is authorized.

Foreign Investment Promotion Board (FIPB) of the Government of India also considers technology imports in industries listed in Annexure A and Annexure B of Schedule 1 of the Foreign Exchange Management Regulations, 2000, subject to compliance with the provisions of Industrial Policy and Procedure as notified by the Ministry of Commerce and Industry Secretariat for Industrial Assistance (SIA) from time to time.

A type of cross-border investment in which an investor from one country has a long-term stake in and considerable influence over a company from another country. FDI is an important component of international economic integration because it establishes solid and long-term linkages between economies.

FDI is an important component of international economic integration because it develops stable and long-term ties between economies.

Growing pressures on government funds, as well as widespread concern about the quality of services provided by incumbent corporations, culminated in a surge of private sector FDI into infrastructure, particularly in developing nations.

In the financial year 2021, India’s infrastructure industries received around 7.9 billion dollars in foreign direct investment equity. In comparison to past years, this was a significant rise. The government’s “National Infrastructure Pipeline” encourages private and foreign investment in the infrastructure sector, which might explain the increase in FDI inflows.

The Civil Aviation sector has been divided into three sectors for the purpose of FDI policy:

Under the automatic route, 49 percent FDI is authorized in scheduled air transport services and domestic scheduled passenger carriers. The limit for non-resident Indian (NRI) investment is 100 percent. A foreign airline must invest through the approved method, and the 49 percent maximum applies to both FII and FDI.

Under the “automatic method,” which includes initial public offerings (IPOs), private placements, ADR/GDRs, and acquisition of shares from existing owners, foreign direct investment (FDI) up to 49 percent is permissible in Indian private sector banks.

VOTING RIGHTS FOR FOREIGN INVESTORS:

Real Estate

In March 2005, the Indian Government changed current regulations to enable 100 percent foreign direct investment in the building industry. The liberalization act clears the way for foreign investment to fulfill the need for commercial and residential real estate development. It has also prompted a number of global financial institutions and private equity funds to form dedicated funds focused on the real estate market.

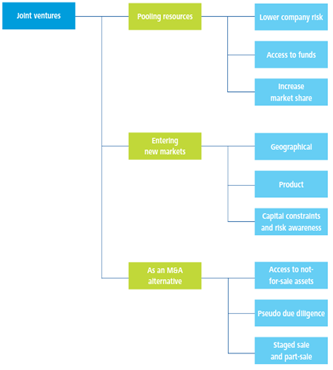

A JV (Joint Venture) is a type of commercial partnership wherein two or more entities commit to sharing their assets, technology, expertise, skills, etc. to achieve some certain goal. This action might be the start of a fresh initiative or some different type of commercial operation. Each partner in a JV is liable for the earnings, expenses, damages, and expenditures linked with it. Moreover, the venture is a distinct business corporation from the partners’ existing economic concerns.

A corporation can create a joint venture with an overseas entity to experience global commerce without carrying on all the responsibilities of multinational commercial operations. Overseas entrepreneurs who form a joint venture reduce the risks associated with buying a company entirely. Due diligence on the overseas destination and the partner is important in international company expansion since it reduces the risks associated with a commercial deal.

The present economic slump has further increased the attraction of leveraging strategic possibilities via global partnerships but even some of the wealthiest corporation’s dearth’s the adequate infrastructure, facilities, expertise, and managerial power to penetrate emerging foreign economies. Industrial partnerships of different types enable enterprises to penetrate the international economies quite inexpensively and efficiently. Statutory and administrative disparities, as well as cultural, linguistic, and monetary anomalies, end up making International Joint Venture (IJV) cooperation an appealing alternative.

A corporation can create a joint venture with an overseas entity to experience global commerce without carrying on all the responsibilities of multinational commercial operations. Overseas entrepreneurs who form a joint venture reduce the risks associated with buying a company entirely. Due diligence on the overseas destination and the partner is important in overseas company expansion since it reduces the uncertainties associated with a commercial deal.

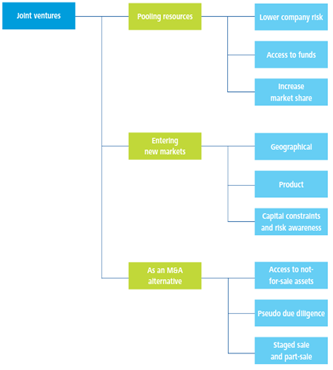

Among the most significant joint venture pros is that it may assist your company, in growing faster, enhancing efficiency, and intensifying profitability. Joint ventures also provide the following advantages:

These advantages are particularly important for a small or medium-sized company that lacks the funding, manpower, or experience to explore a possibility except it can split the business risks and expenses via a collaboration, such as an international joint venture. IJVs enable parties to operate swiftly, cost-effectively, and with reliability in the domestic economy.

An additional advantage of a joint venture is its adaptability. A joint venture, for instance, may have a finite lifespan and only encompass a portion of what you do, restricting all the partners’ engagement and the company’s risk. Joint ventures are particularly prevalent among firms that operate in many nations, such as those in the transportation and tourism industry.

Joint ventures also have a relatively higher rate of failure, with many failures being extremely expensive to the participating enterprises. As per the BCG analysis, over 90 Japanese companies failed between the period of 1972 and mid-1976. Most of such organizations were big initiatives involving well-known American corporations like Avis, Sterling Drug, General Mills, and TRW. Harvard Business School research found that the joint ventures were unsuccessful due to tactical and administrative modifications undertaken by the venture’s owners. These businesses were either dissolved or acquired by one of the partners, or ownership was transferred from one to the other.

If there is insufficient preparation and management, an international joint venture may be a stressful journey and, eventually, a catastrophe. Market trends, technological challenges, bureaucratic concerns, and economic slumps can all be challenging to predict and have a crippling effect on IJVs.

Revenues from an IJV are diminished since they are allocated by default. Management challenges might develop despite having proper channels in place to settle conflicts due to the partners’ diverse organizational ideologies. The collaborators may also learn that they do not end up sharing objectives and are not adaptable enough to modify and suit the business’s developing demands. Joint ventures are sometimes challenging to finance as an organization, specifically in terms of borrowing, because their life is temporary and hence lacks stability.

Thanks & Best Regards,

RAJIV TULI

LEGALLANDS

E. [email protected], W. www.legallands.com

This page is dedicated to keeping readers informed of the latest news and thought leadership articles from law firms across the globe.

If your firm wishes to publish press releases or though leadership articles, please contact [email protected]